From the Editor: In part 1 of this two-part series from Kevin Smith, creator of the Pragmatic Enterprise Architecture Framework (PEAF™), we hear about the often ignored but vitally important topic of debt as it relates to change within organisations. With the term “Digital Transformation” being almost ubiquitous in businesses at the moment, understanding the implications of decisions within an organisation’s change program has never been more relevant. Whilst debt is not always a bad thing, un-managed can be, and often is, disastrous.

If you don’t control your Enterprise Debt™, it will control you…!

by Kevin Smith

What has this got to do with Digital disruption?

The operative word in that phrase is the word “disruption”. Disruption is change, and in this context is relating to the way Information Technology is changing. However, since the buzzword of the day is “Digital” rather than Technology, hence Digital Disruption. Digital disruption however is nothing new, but has been coming in waves ever since the early 80’s. As technology changes, new business models, markets, customer segments, legislation, and many other things also change. Our focus here is to consider how “Digital Disruption” is causing Enterprises to change to accommodate it.

Fundamentally, the world we live in is changing faster than ever before. “The only constant is change!” has been the battle cry for many years but just being able to deal with change is no longer enough. The new battle cry is “The only constant is the acceleration of change!” How an Enterprise effects the whole of Transformation is becoming a Strategic Strength or a Strategic Weakness, where massive business opportunities can be gained or massive business problems will result.

Hence, HOW an enterprise changes is the key to be able to deal with not only digital disruption, but disruption (change) of any kind. Disruption (change) that is only increasing in frequency as well as the impact those changes are likely to have on an Enterprise.

Architecture of any kind exists to help people (and therefore Enterprises) deal with the complexity and volatility of things. Enterprise Architecture therefore exists to helps people (and therefore Enterprises) deal with the complexity and volatility of an Enterprise.

The purpose of EA is to support, enable and guide the continual changes an Enterprise needs to make to itself , but EA is just one part of a larger Transformation domain (from strategy to deployment) that exists in all Enterprises. So it’s not that EA is strategically important per se, It is the ability to Transform that is strategically important. For CxOs, Execs and Shareholders, and indeed for the Enterprise’s survival, and EA is a key cog in that machine.

A key part of EA is the ability to spot things early when they begin to go wrong (EA Governance). The ability to spot when projects begin to diverge from the planned roadmaps, and more importantly the ability to do something about it; to make valid business decisions about what to do when that happens.

Governance & Lobbying is the glue which connects each phase together in an aligned and cooperative manner.

Governance has long been seen as either some kind of policing activity where people are either forced to comply with things, or alternatively a watered down box ticking exercise. Both approaches are insidiously destructive as they appear to have solved a problem when in fact they are making things worse!

In fact the first part of governance is often overlooked – that of handover. There needs to be some handover to explain the why, to explain the constraints, to explain the reasons behind the decisions that have been taken.

The key to effective governance is balance that Lobbying provides, and is built upon the simple premise that a problem or an opportunity can be discovered at any time by anyone, rather than the “normal” western type management approach which tends to be “the person who is right is the person who is more senior”.

Things change. Always. Continually. Guaranteed. So you can either ignore that inconvenient truth, or accept it and put in a method to deal with it when it does happen. In the domain of Transformation, it is not only the change related to the transformation we are executing, but more importantly change to the context – the why – that we must also deal with.

What we decided to do yesterday (and how and why) for many good reasons could be a massively bad thing to do today. This is a fact of life in the 21st century. So, if we are to deal with transformation in a Pragmatic way we need to accept this fact and deal with it rather than pretend it doesn’t exist and hope for the best. The overall idea that someone creates a strategy and 24 months later it is delivered is rubbish. The plans for the project portfolio (and the reasons) could (and generally do) change as the projects execute. Therefore we need a holistic and coherent environment for transformation to happen within which allows us to backtrack as soon as possible, rather than blindly following a flawed plan.

It is not only that work at any level can deviate from guidance (it will – the devil is in the detail), but also the fact that the strategic plan or roadmap changes (or should change). These are the factors that cause the disconnect between each level.

Most Enterprises already have some kind of EA governance but in most cases, the way that is done is not fit for purpose anymore. There are various Enterprises that do governance in a reasonable way, but many more that do not. You only have to look at the constant statistic of 70% failure rate in projects to know that. Governance in the majority of Enterprises is often approached from a policing point of view or left to languish as a tick the boxes exercise. There is a new, effective, efficient and easy way to mature that EA governance, and that is Governance and Lobbying using Enterprise Debt™. Enterprise Debt (or rather the exposure and management of it) offers the key to effective EA governance, and Lobbying (the yin to Governance’s yang) is the work that exposes it.

The concept of Enterprise Debt™ was created in 2008 as part of PEAF. It is based on the concept of Technical Debt. Pragmatic EA Ltd has since clarified, expanded and developed the concept into a practical and easily usable methodology that can be easily adopted.

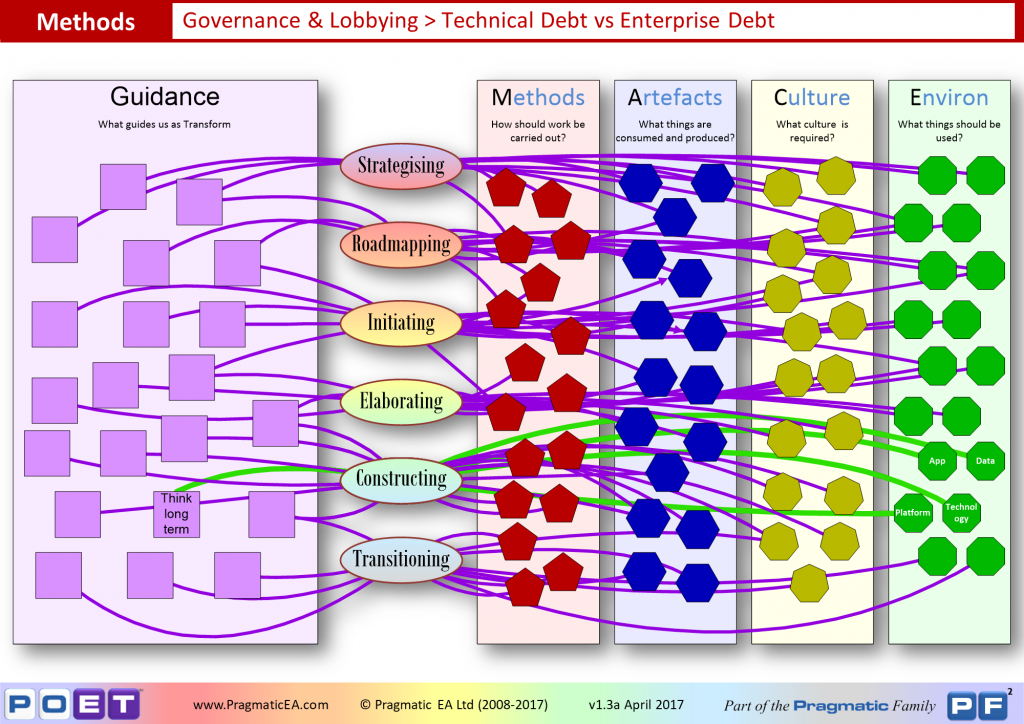

Enterprise Debt™ takes this basic idea of Technical Debt (which considers only one type of guidance “Think Long Term” in relation to IT Solutions, illustrated on the graphic with green lines), and expands it in 3 very important ways (illustrated on the graphic with purple lines):

- Enterprise Debt™ applies not only to IT, but also (using MACE defined in the Pragmatic Operating model for Enterprise Transformation – POET) to the Methods, Artefacts, Culture and the rest of the Environment domain (such as frameworks and locations) that IT is only a sub-domain of.

- It applies not only to one kind of guidance (“Think Long Term”) but to all types of Guidance (Values, Principles, Policies, Standards, etc.) that guide HOW we effect Transformation, which includes the Structural Guidance provided by the phases above.

- It applies not only in one phase (Constructing) but in all phases of the Transformation stack (Strategising, Roadmapping, Elaborating, Constructing and Transitioning).

In this way, Enterprise Debt™ sits at the heart of the Governance & Lobbying (the work that exposes Enterprise Debt™) disciplines which are the glue that makes the whole Transformation cascade coherent and therefore effective and efficient.

It provides the concept, mechanism and practical guidance that allows for problems or opportunities to be exposed (whenever and wherever they occur), and for them to then be evaluated and raised to the correct level for a decision to be made regarding their resolution, in the full knowledge of the implications of doing so or not doing so.

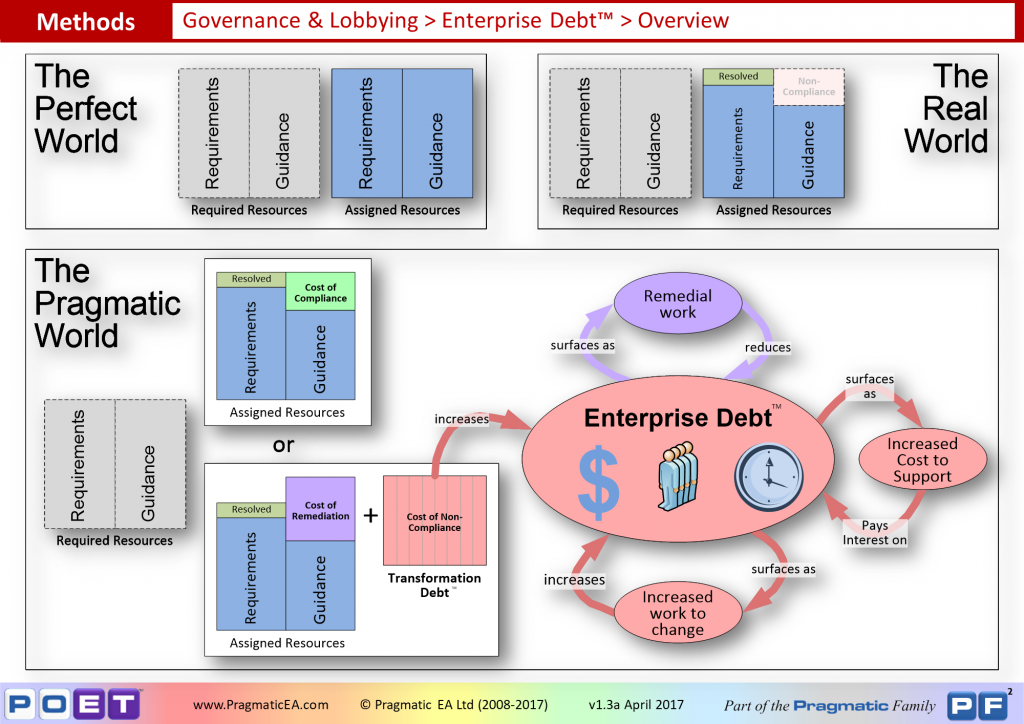

In order to understand Enterprise Debt™ more fully, let us compare what happens in an Enterprise that does not expose and manage Enterprise Debt ™ to one that does.

Considering the graphic above:

- Resources – money, time, people, etc. – whatever is required to effect a transformation.

- Requirements – the resources associated with satisfying the requirement of the work.

- Guidance – the Resources associated with satisfying the things that guide and influence how we satisfy the Requirements. Things like Principles, Policies, Standards, etc., but also things like conforming to the structures and methods imposed on us.

- Required Resources – the Resources that are required to satisfy the Requirements and conform to the Guidance.

- Assigned Resources – the resources that are actually provided – which are always less than those that are required!

Don’t forget that Governance & Lobbying happens at each level of the Transformation cascade and therefore each level has to conform to (or lobby against) the guidance (Structural and Transformational) from the level above.

The Perfect World

In the perfect world, the Assigned Resources (what we are given) would always equal the Required Resources (what we need). But that never happens…

The Real World

In the real world, the Assigned Resources very rarely equal the Required Resources.

From the point of view of requirements, this is usually managed, as any requirements that will not be met are usually identified and either:

- resource is brought to bear to satisfy them, or

- they are “de-scoped”.

This is not where most of the problems that derail Transformation efforts lie.

The problem comes from the Guidance, or rather from the fact that appropriate resources are not available to satisfy the Guidance. Even more correctly one can say that the problems arising from this Non-Compliance is largely hidden and therefore ignored. In fact many Enterprises take a very dim view of exposing these problems. There may very well be valid business reasons for this, but a lot of the time this restriction can be pretty arbitrary.

“There is never time to do it right, but always time to do it over.”

“A short-cut is the longest distance between two points.”

I have personally worked on countless projects that had drop dead go live dates that, if missed, would mean the world would end – but in reality it never did. I have also worked on countless projects where the money required was not made available – again for some pretty arbitrary reasons – but in reality those restrictions meant the project ended up spending far more. I am sure you have too.

Restriction of resources tends to be the very simplistic (and ultimately severely damaging) control mechanism that management uses in relation to Enterprise Transformation, as well as the simplistic management style of always asking for more for less. This leads people to produce inflated estimates (assuming that they will be cut) and management not believing them (assuming they will be inflated).

For most Enterprises that’s where it stops. People have to muddle through somehow – put their nose to the grindstone – work as team – forge ahead – think positive thoughts – don’t be negative, etc. Perhaps some lip service is paid to this gap – some entry in a risk register that is never used for anything – but that’s about it. There will be implications, but those implications are not known, and will only be discovered later when nothing can be done about them (and those that could have done something about them have moved on to far more important things).

But, let us be clear.

Not providing what is asked for, is not the problem.

Ignoring the implications is!

The Pragmatic World

In the Pragmatic world, things start off the same as in the real world i.e. the Assigned Resources very rarely equal the Required Resources. However, in the Pragmatic world we accept this inconvenient truth and do something about it. We recognise that there are three things to expose and consider.

- Cost of Compliance – What is preventing the Enterprise from complying with the guidance, and what is required to allow the Enterprise to comply?

And, assuming what is required is not provided…

- Cost of Non-Compliance – What issues and risks going forward will this non-compliance create for the Enterprise? (Transformation Debt™)

- Cost of Remediation – What will it cost the Enterprise to become compliant in the future.

This Transformation Debt™, is what it will cost to service the debt and what it would cost to bring the work being done up to the same standard as would have been produced if the Assigned Resources had been provided. Notice that the Cost of Remediation is bigger than the difference between the Required Resources, and the Assigned Resources. This is because it will always cost more to do something one way, and then change it to another, than it would have cost to just do it right the first time.

A Business Decision is then made to either provide what is required to comply (Cost of Compliance) or to accept the implications of not doing so (Cost of Non-Compliance + Cost of Remediation). If the Business decision is made to not provide what is required to comply, this Transformation Debt™ adds to overall Enterprise Debt™.

Enterprise Debt™ is a measure of the resources that would be required to pay off the debt. But Enterprise Debt™, like financial debt, also has to be serviced in the form of interest payments, for example increased support costs. Like interest payments on a loan, this is a recurring cost and will continue for as long as the Enterprise Debt™ it is servicing exists.

In addition, if the thing that was transformed now needs to be transformed again, there will also be an increased cost to effect that change. This change also requires resources, and if the Assigned Resources for this change does not equal the Required Resources for this change, we are introducing even more Enterprise Debt™ into the Enterprise – a double whammy! This is akin to taking out another loan to pay the interest on a current loan!

However, it’s not all doom and gloom. If it is recognised that we need to do some remedial work, (or more likely, things just get so bad the Enterprise has no choice but to do some remedial work) this reduces Enterprise Debt™ and is therefore akin to paying off (some) of the debt.

Recognising and managing Enterprise Debt™ provides a simple and extremely effective control mechanism for management to get back in control of their Transformation initiatives, and for those working in them to produce quality work (and to be able to sleep at night!)

Enterprise Debt™ is not an exercise in making sure that the Assigned Resources always equals the Required Resources.

Enterprise Debt™ makes sure that when the Assigned Resources does not equal the Required Resources (i.e. most of the time), that the implications are exposed. That way, management can make informed business decisions in the light of that information.

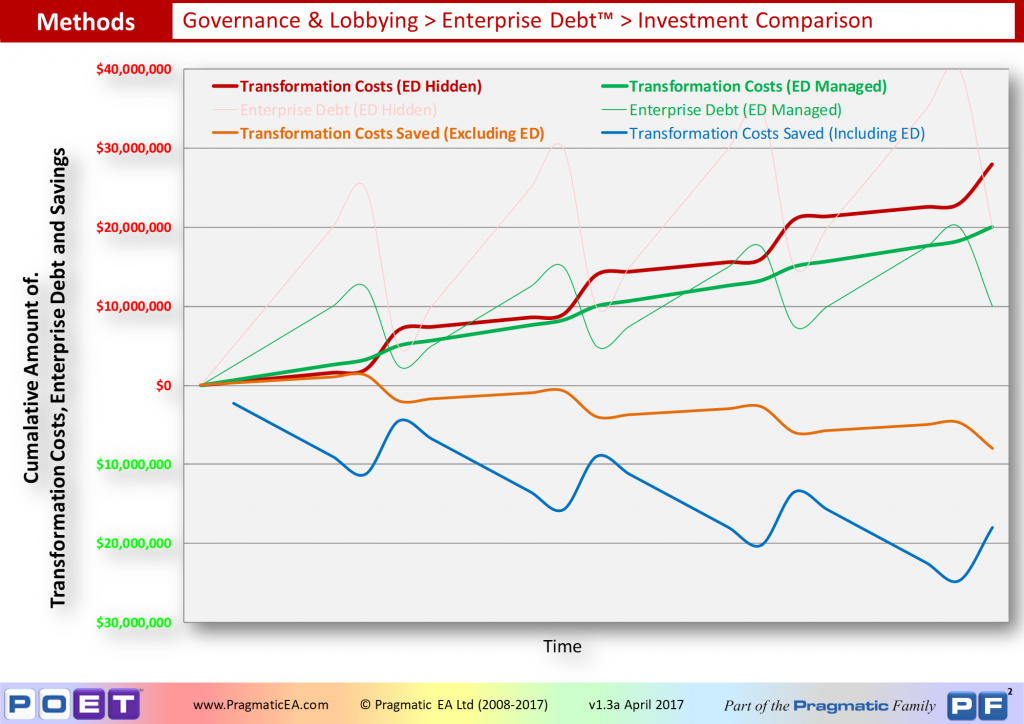

Firstly, consider the red line, which illustrates the cumulative Transformation Costs of an Enterprise that does not expose and manage Enterprise Debt™, and is typical of many Enterprises.

Cumulative Transformation Costs rise, but very slowly, while Transformation Costs are kept low. During this time, hidden Enterprise Debt™ is slowly building up…

When this hidden Enterprise Debt™ reaches a critical point (akin to when the pile of dirt that is swept under the carpet has become too big to ignore any longer), a very large and abrupt rise in Transformation Costs is required to deal with it. Often referred to as “getting the car out of the ditch”, its focus is usually very tactical – short term and only concerned with dealing with the major issue that cannot be ignored any longer.

Having spent a large amount of money on Transformation over a very short timeframe, the focus then tends to be, once again, to keep Transformation Costs low and therefore we return to the low level of Transformation Costs we saw before and the whole process repeats itself.

Not exposing and managing Enterprise Debt™ is characterised by:

- Low Transformation Costs while hidden Enterprise Debt™ builds up…

- Followed by large, unplanned and abrupt Transformation Costs when things get too bad…

- Causing Un-predictability, which leads to Instability, which means management is not in Control.

These large, unplanned and abrupt rises in Transformation Costs can often occur at the same time that an incumbent CIO is replaced by another! This is obviously not good news for the CIO, but more importantly, it is not good news for the entire Enterprise.

Not exposing and not Managing Enterprise Debt™ is like boom and bust in the economy, and we all know the effects of boom and bust!

Secondly, consider the in green line, which illustrates the cumulative Transformation Costs of an Enterprise that does expose and manage Enterprise Debt™.

Cumulative Transformation Costs rises more steeply than before, as management decisions release resources to keep Enterprise Debt™ under control.

Enterprise Debt™ does build up, but this debt is exposed and managed and does not get as large as before, purely because we are managing it and spending money wisely.

Since we are managing Enterprise Debt™, increased Transformation Costs to reduce it can be planned ahead, so that when debt reaches a critical point, we can reduce it in a controlled way.

In addition, while this increased Transformation Cost solves any short term problems that may be evident, it is also aligned to longer term goals.

After the increased Transformation Costs, we again return to a more moderate level of Transformation Costs and the whole process repeats itself.

Exposing and managing Enterprise Debt™ is characterised by:

- An Increased level of Transformation Costs while Enterprise Debt™ is exposed and managed…

- Followed by moderate Transformation Costs when planned…

- Providing Predictability, which leads to Stability, which means management is in Control.

Exposing and Managing Enterprise Debt™ relieves this boom and bust investment cycle. The downside is that it requires an increased initial investment in the short term. The upside is that it requires lower investment over time and prevents Enterprise Debt™ from spiralling out of control.

Finally, consider the Blue and Orange lines. They both are illustrations of the difference between Transformation Costs if we do not utilise Enterprise Debt™, and Transformation Costs if we do utilise Enterprise Debt™, essentially showing the savings that would be made by managing Enterprise Debt™ compared to not managing it.

They essentially answer the question:

“If I manage Enterprise Debt™ how much money will I save?”

The lines shown as negative = savings, positive = costs.

The difference between them is that the Blue line includes the savings we also make in Enterprise Debt™ while the Orange line does not.

Transformation Costs Saved (Excluding ED) = Transformation Costs (ED Managed) – Transformation Costs (ED Hidden)

Transformation Costs Saved (Including ED) = Transformation Costs Saved (Excluding ED) + [ Enterprise Debt (ED Managed) – Enterprise Debt (ED Hidden) ]

Although the Orange line does show savings over time, the savings appear moderate and indeed rise initially, meaning there are no savings at all – in fact it will cost us more!!!! But, when you factor in the Enterprise Debt that we are saving, the Blue line shows how massive the savings can become.

The key takeaway here is:

“If you don’t control your Enterprise Debt™, it will control you.”

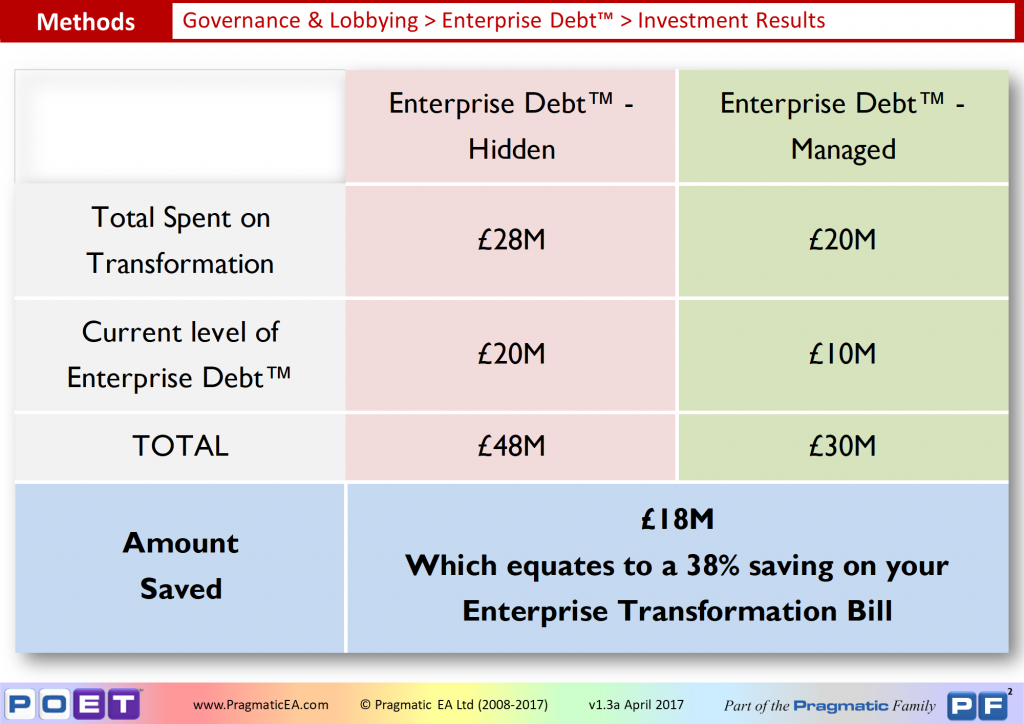

Considering the final results on the right hand side of the graph, we can see that over time the savings can be huge.

Enterprise Debt™, like any debt, is not inherently a bad thing though. Used correctly it is a massively important Strategic Management tool. But like any debt, Enterprise Debt™ is only bad when:

- It is hidden and you don’t know you are incurring it, or

- You don’t know how you will pay off the debt, or

- You don’t know the interest rate, or

- You don’t know how long you will have to pay the interest, or…

- …all of the above!

When times are good, you can invest in reducing Enterprise Debt™, which means when times are bad, you can lean on Enterprise Debt™ by allowing a controlled increase.

However, if you do not expose and manage Enterprise Debt™, your Enterprise Debt™ could already be too high to allow you to ride out the bad times. If you max out your credit card, how will you be able to fix your car when the exhaust falls off?

IN PART 2 OF THE SERIES, WE WILL DELVE MORE DEEPLY INTO ENTERPRISE DEBT™ AND IT’S USE FOR THE GOVERNANCE AND LOBBYING OF PROJECT EXECUTION….

One Comment