Exploring the Global Payments Industry with the ArchiMate Language: Part One: Key Roles and Core Processes

By Iver Band

EA Principals Senior Instructor and ArchiMate Expert

Introduction

Ever wonder what happens behind the scenes when you order something online or use a credit card in a bricks-and-mortar establishment? This series uses the ArchiMate language to explore the global payments industry that touches all of us. Today, we use the ArchiMate Business layer to explore key industry roles and core processes. Today’s content is largely based on a white paper available here, and all of the models for this series are created with the Archi free and open source modeling tool.

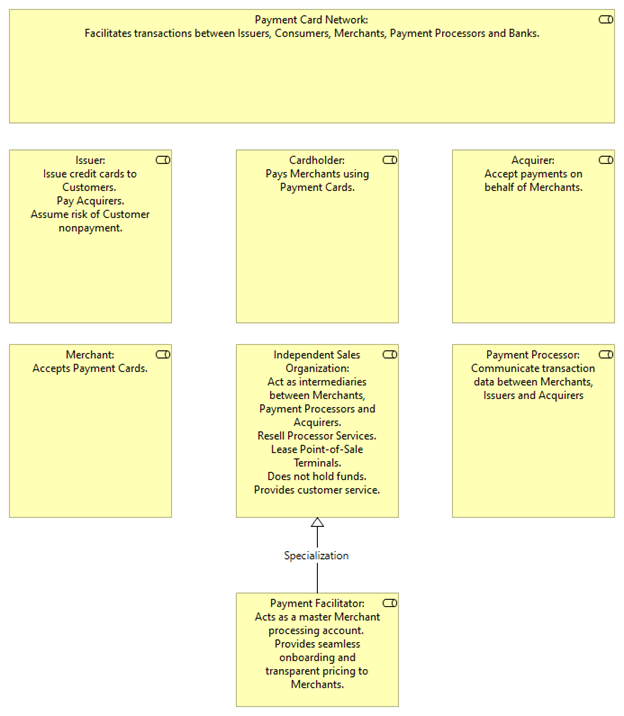

Key Roles

The key roles in the payment industry are modeled with the ArchiMate business role element, which denotes a responsibility for performing specific behavior. The Payment Facilitator role is modeled as a specialization of the more general Independent Sales Organization role. This is not an exhaustive model; critical roles such as regulators and standards bodies are reserved for a future article in this series, as are more specialized businesses such as technology providers.

The key roles in the payment industry are modeled with the ArchiMate business role element, which denotes a responsibility for performing specific behavior. The Payment Facilitator role is modeled as a specialization of the more general Independent Sales Organization role. This is not an exhaustive model; critical roles such as regulators and standards bodies are reserved for a future article in this series, as are more specialized businesses such as technology providers.

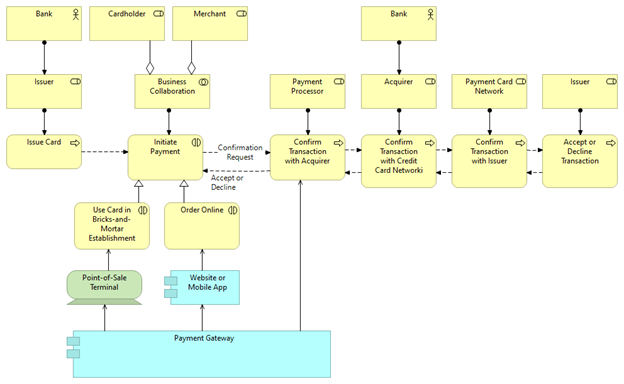

The Authorization Process

When we use a credit card, the transaction is approved or declined very quickly. This diagram models what happens as a series of ArchiMate business processes connected with flow relations that denote the transmission of information and funds. Most of the business roles modeled in the previous diagram are assigned to perform one or more business processes. The assignment relation is also used to indicate that the Acquirer and Issuer roles must each be performed by a Bank (not necessarily the same one, since Bank is used generically here).

When we use a credit card, the transaction is approved or declined very quickly. This diagram models what happens as a series of ArchiMate business processes connected with flow relations that denote the transmission of information and funds. Most of the business roles modeled in the previous diagram are assigned to perform one or more business processes. The assignment relation is also used to indicate that the Acquirer and Issuer roles must each be performed by a Bank (not necessarily the same one, since Bank is used generically here).

The diagram shows additional detail for the Initiate Payment step, which is modeled as a business interaction performed by a business collaboration consisting of the Cardholder and Merchant business roles. Initiate Payment is specialized by two types of interactions. In-store payment initiation is served by a Point-of-Sale Terminal device (a Technology layer element), while online ordering is served by a Website or Mobile App application component (an Application layer element). Both the terminal and the Website or Mobile App are served by the Payment Gateway, which also serves the Confirm Transaction with Acquirer business process.

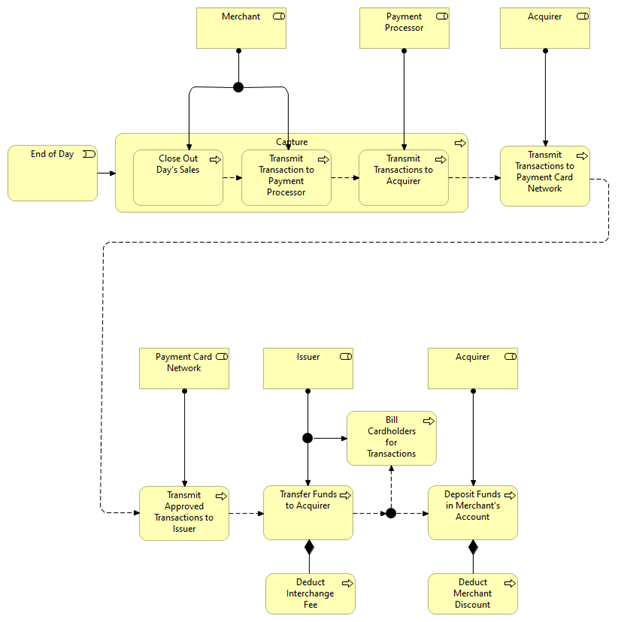

The Settlement Process

The Settlement Process is triggered by a business event: the arrival of the end of the business day. The Settlement Process begins with the Capture process, which is composed of three subprocesses. Composition is denoted by nesting here. This diagram also uses an and junction to unambiguously assign two business processes to the Issuer role and to show that there are flows from the Transfer Funds to Acquirer process to both the Bill Cardholders for Transactions and Deposit Funds in Merchant Account process. Finally, both the Transfer Funds to Acquirer and Deposit Funds in Merchant’s Account processes include fee deduction subprocesses denoted by the composition relation connector rather than by nesting.

The Settlement Process is triggered by a business event: the arrival of the end of the business day. The Settlement Process begins with the Capture process, which is composed of three subprocesses. Composition is denoted by nesting here. This diagram also uses an and junction to unambiguously assign two business processes to the Issuer role and to show that there are flows from the Transfer Funds to Acquirer process to both the Bill Cardholders for Transactions and Deposit Funds in Merchant Account process. Finally, both the Transfer Funds to Acquirer and Deposit Funds in Merchant’s Account processes include fee deduction subprocesses denoted by the composition relation connector rather than by nesting.

Until Next Time

We have covered some of the basics of the global payments industry and shown how the ArchiMate Business layer can be used to describe complex processes at an architectural level. In the coming articles, we will use the ArchiMate language to explore industry standards and regulation, more specialized roles, key industry players and both mainstream and emerging technologies.

Great article!

Some questions/comments:

– Shall Merchant be a role? Is it not rather an actor (like Bank)? If so, some process-specific role assigned to this actor should be defined.

– Shall “Payment Card Network” be role? Is it not just a technical means for doing the transactions?

– The “Independent Sales Organization” does not have its place in the Authorization process? It is not part of the auth process itself but the “Issue card” is not either – and you have it in the view.